KYB Verification API

Trust your Business

Verify UBOs, documents, and bank accounts in real-time across 180+ countries. Scale fearlessly with AI-powered business verification that adapts to new geographies, documents, and risk patterns.

Simple. Secure. Compliant

160M+

Businesses Verified

Grow fearlessly with APIs that scale with your business. Millions trust Signzy for secure and seamless partner verification.

97%

API Accuracy

Access unmatched global data coverage and near-perfect precision to ensure you never let a fraudulent company in.

180+

Countries Coverage

Screen businesses in 180+ countries and 50 U.S. states against company databases and registries to verify business names, TINs, and more.

Trusted by industry leaders

Build business relations with genuine data

ransform weeks of back-and-forth verification into an instant, automated process that your business customers will actually enjoy

Foolproof fraud detection with AI-powered KYB

Don't let shell companies and synthetic identities slip through. Our advanced document forensics flag inconsistencies in corporate filings, beneficial ownership structures, and financial records. Combined with real-time database validation across 180+ countries, fraudulent entities don't stand a chance.

Perpetually compliant across every geography

Enter new markets confidently. Signzy tracks every local regulation and pushes updates automatically, keeping your KYB workflows compliant without spreadsheet wrangling or last-minute code scrambles. Focus on growth while we handle the compliance complexity.

Instant business intelligence that moves deals forward

Verify company registration, beneficial ownership, and financial standing instantly. Give your risk and finance teams the assurance they need to approve legitimate businesses and flagquestionable ones before money or goods change hands. No more waiting days for manual verification.

Scale without drowning in compliance

Expand fearlessly and minimize business risk

Explore the complete business verification stack and catch what manual checks miss.

Business Document Verification

Validate bank statements, articles of incorporation, UCC filings, and many more documents to build a comprehensive company profile.

Business Database Checks

Validate business data for in-depth business intelligence and streamline your KYB processes including vendor onboarding, verification, and detailed data retrieval.

EIN Verification

Get accurate validation of EINs against official records to support KYB with details such as business name, license, industry, address, and more.

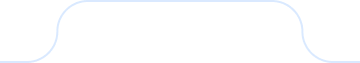

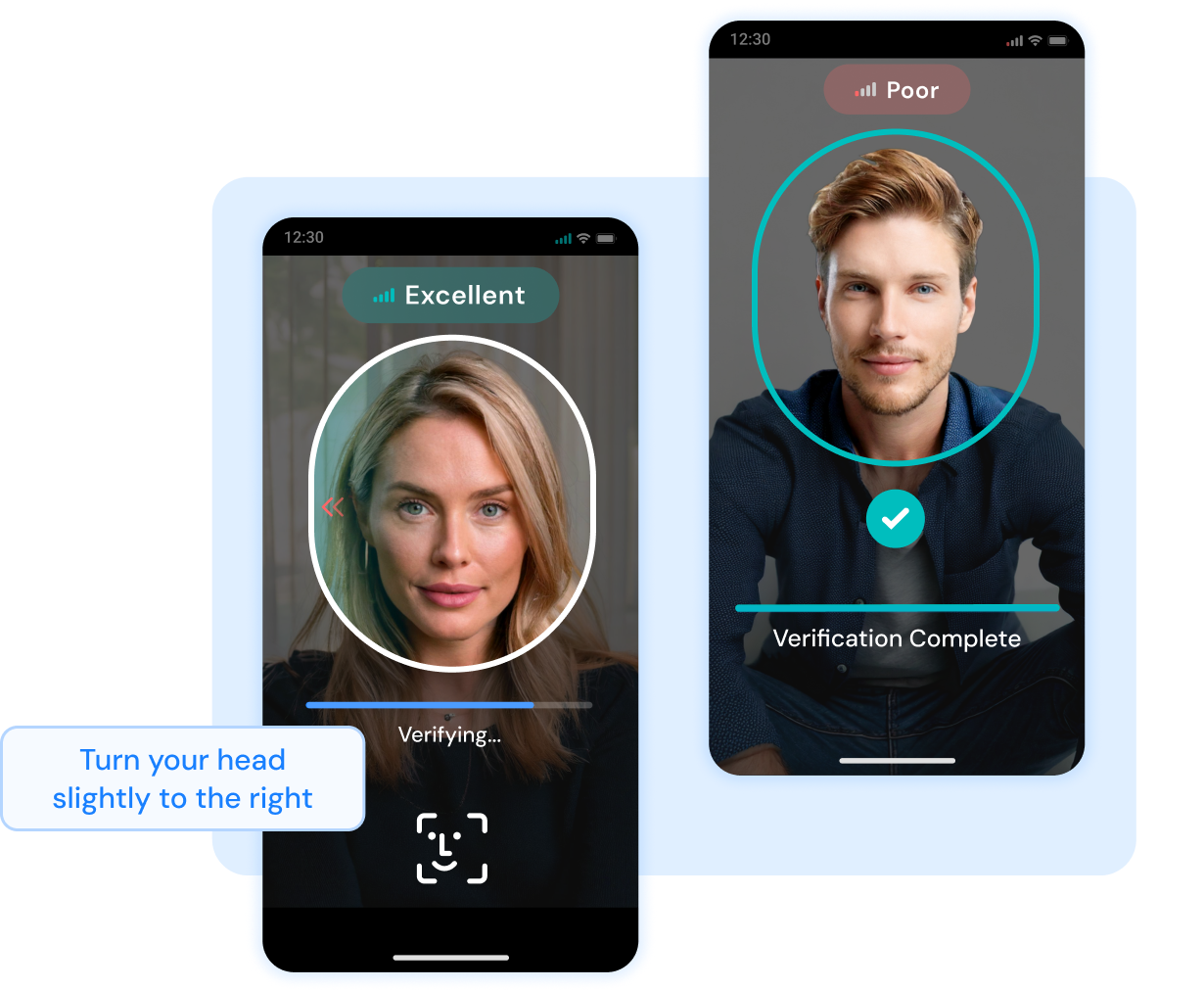

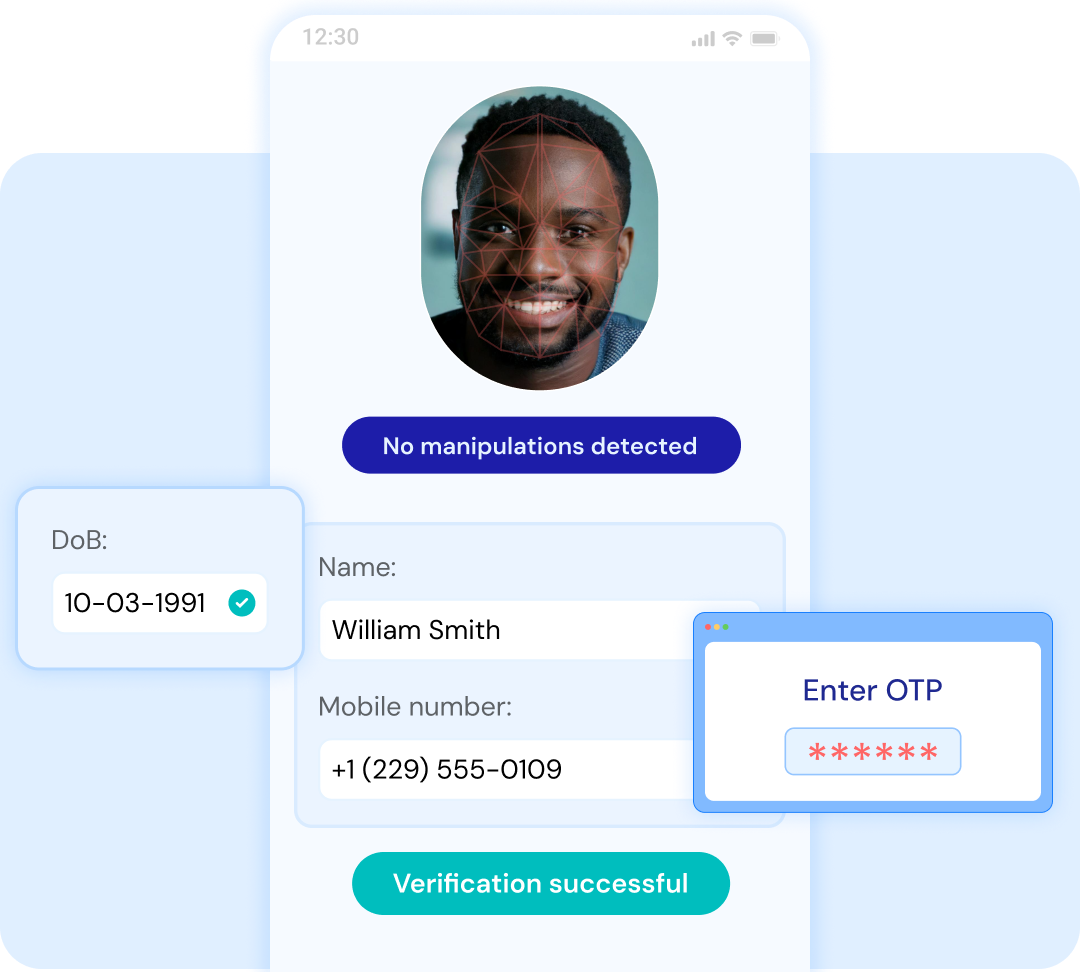

Global KYC

Simplify the Know Your Customer (KYC) process with AI-driven fraud detection, biometric checks, database screening, and more.

Developers love us for a reason!

Integrate the API during lunch hour, customize based on your needs, and go live within 2-4 weeks!

Related Blogs

FAQ

What is KYB verification and why do businesses need it?

Know Your Business (KYB) verification validates a company's legitimacy, ownership structure, and compliance status. It's required by AML regulations to prevent money laundering, identify beneficial owners, and ensure you're partnering with legitimate entities. KYB helps businesses avoid fraud, meet regulatory requirements, and build trust with financial institutions.

What business documents can Signzy verify for KYB compliance?

We verify 10,000+ document formats including business registration certificates, articles of incorporation, tax IDs (EIN, GST, VAT), bank statements, beneficial ownership documents, and director identification across 180+ countries. Our platform handles everything from US LLC formations to international corporate filings.

How does Signzy detect shell companies and fraudulent businesses?

Our AI-powered document forensics analyze inconsistencies in corporate filings, validate beneficial ownership chains, and cross-reference multiple databases in real-time. We flag suspicious ownership structures, dormant entities, and document tampering. Combined with global registry validation, shell companies and synthetic business identities can't slip through.

How long does business verification take and which countries are supported?

Most KYB verifications complete within 2-5 minutes via our real-time API. We support business verification across 180+ countries including the US, Canada, UK, EU, Australia, and Singapore. Complex corporate structures may require additional processing time, but comprehensive reports are typically ready within the same business day.

Is Signzy's KYB platform compliant with AML and regulatory requirements?

Yes. Our KYB solution meets global AML compliance standards including BSA, CDD, and Enhanced Due Diligence requirements. We maintain complete audit trails, provide risk scoring, and generate compliance reports that satisfy FinCEN, FCA, AUSTRAC, and other regulatory guidelines across different jurisdictions.

What if I run into an error? Is there documentation?

You can email us at connect@signzy.com, and we'll try our best to assist you.